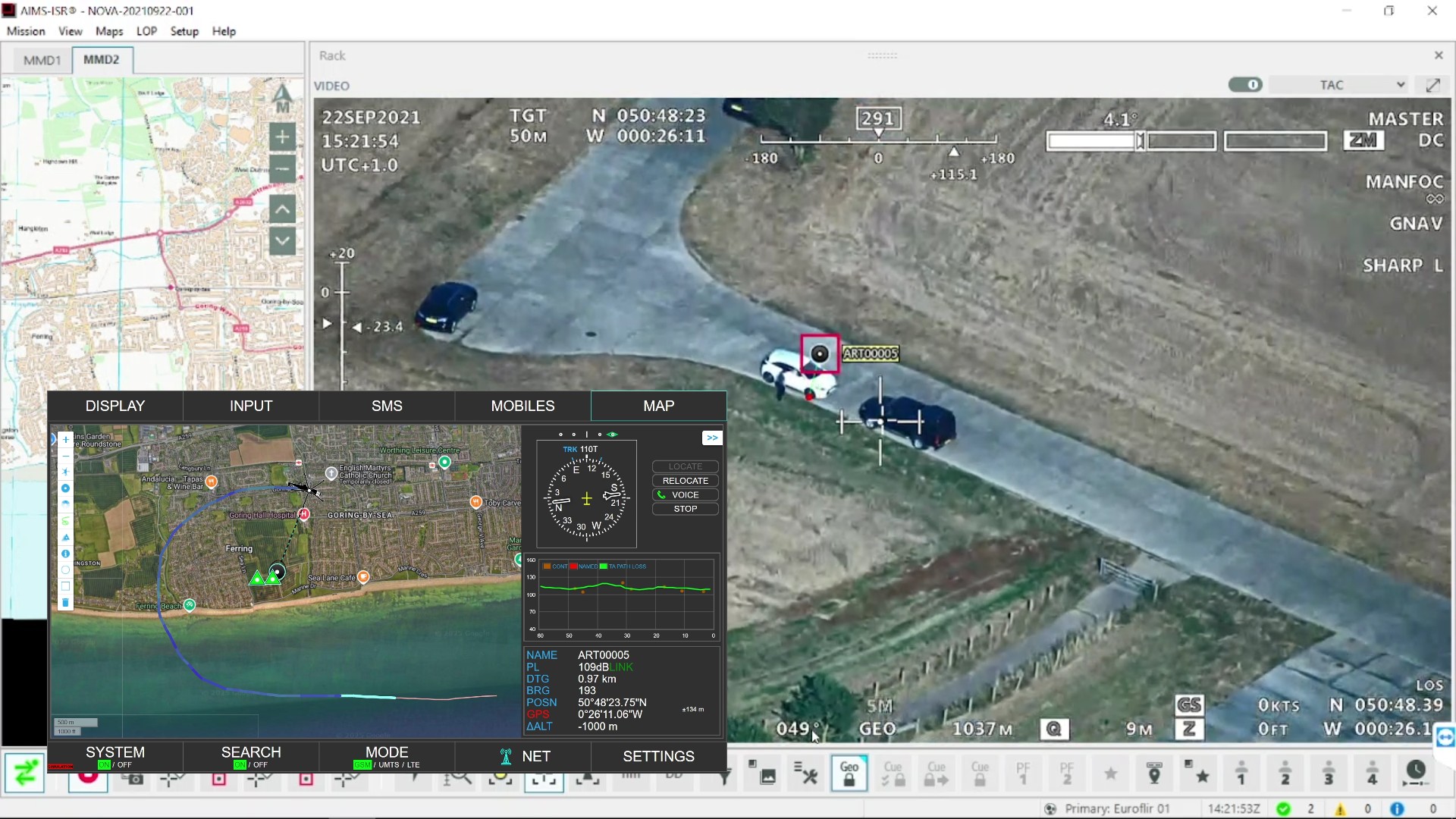

ACI EUROPE charts stop-start recovery for Europe’s airports

Image courtesy ACI EUROPE

While passenger traffic across the European airport network increased by +37% in 2021 compared to 2020, it still remained -59% below pre-pandemic (2019) levels.

Olivier Jankovec (above), Director General of ACI EUROPE said: “After losing 1.72 billion passengers in 2020, we all had high hopes for a strong recovery in 2021. Yet last year proved another difficult one, as Europe’s airports ended up losing another 1.4 billion passengers compared to 2019. This means they remain under considerable stress, with systemic financial weakness across our industry.”

Omicron impact

The Delta variant essentially knocked down passenger traffic in the first half of 2021 (-77.7% against 2019), as lockdowns and severe travel restrictions were reintroduced and most intercontinental markets remained out of reach.

The rollout of the vaccines combined with the EU Digital Covid Certificates and the reopening of the transatlantic market in November saw passenger traffic finally improving in the second half of the year (-42.4% against 2019) - although the Omicron variant broke that dynamic in December.

While passenger traffic had been on a progressive improvement path between June (-66.3%) and November (-35.2%) compared to pre-pandemic (2019) levels, it went into reverse again in December (-39.2%). This Omicron impact was focused on the EU+ market1, where airports saw passenger traffic falling by -44.1% in December compared to -38.1% in November. Conversely, the variant did not prevent modest gains in the rest of Europe2 (-17.1% in December compared to -19% in November).

Jankovec commented: “The knee-jerk reaction of many Governments who ignored the ECDC guidance and rushed to reimpose travel bans and other restrictions – including for intra-European travel – has stalled our recovery. Yet, these travel restrictions did nothing to stop the spread of Omicron, as recognised just last week by the WHO and also evidenced by a recent Oxera & Edge Health report3 looking at the situation in the UK.”

EU+ Market v Rest of Europe

In 2021, airports in the EU+ market saw passenger traffic increasing by +29.2% compared to the previous year but still remaining at -64.6% against pre-pandemic (2019) levels.

Compared to 2019, the strongest yearly results came from airports in Greece (-46.8%), Romania (-52,7%), Luxembourg (-53.9%), Cyprus (-55.6%), Bulgaria (-55.9%) – closely followed by Spain (-56.4%) and Portugal (-57.9%). At the other end of the spectrum, airports in Finland (-80.5%), the UK (-78.1%), the Czech Republic (-74.8%) and Ireland (-74.4%) suffered the largest losses in passenger traffic – mainly a reflection of severe restrictions on travel imposed by these countries.

Meanwhile, airports in the rest of Europe significantly outperformed the European average, with passenger traffic increasing by +59.4% in 2021 compared to the previous year and remaining at just -34.4% compared to pre-pandemic (2019) levels.

This resulted from generally less severe travel restrictions and lockdowns. Compared to 2019, the best results were posted by airports in Russia

(-24.4%) and Armenia (-29.3%). Israel (-72.9%) was a notable exception amongst the bloc.

Top Five League

During the 4th quarter of 2020 and 1st quarter of 2021, the Majors (five busiest European airports) were all Turkish and Russian airports.

For the full year 2021, Istanbul (-46% compared to pre-pandemic - 2019 - levels) was the busiest European airport, followed by Moscow-Sheremetyevo (-38%) but Paris-CDG (-65.6%) and Amsterdam-Schiphol (-64.4%) rejoined league in the third and fourth position – followed by Moscow-Domodedovo (-11.3%) in the fifth position.

London-Heathrow (-76%) rejoined the Top Five league in November 2021 following the re-opening of the transatlantic market. This is still not the case for Frankfurt (-64.8%), which ranked as the seventh busiest European airport in 2021.

By December 2021, Istanbul remained in the top position, followed by Paris-CDG (second position), London-Heathrow (third position), Madrid (fourth position) and Amsterdam-Schiphol (fifth position).

Smaller regional airports recovering faster

Smaller regional airports have been recovering at a faster pace since last Summer compared to larger airports. This reflects the fact that beyond the transatlantic market, many intercontinental markets remain de facto closed due to severe travel restrictions and that the recovery remains largely driven by leisure and ‘Visiting Friends and Relatives’ travel on intra-European and domestic markets.

In 2021, category 4 airports (less than five million passengers per annum) saw passengers decreasing by -53.5% compared to pre-pandemic (2019) levels whereas category 1 airports (more than 20 million passengers per annum) registered a decrease of -63.3%.

The gap widened over the last months of the year. In December 2021, as smaller regional airports were generally less impacted by the Omicron-related travel restrictions - as these spared domestic travel - category 4 airports saw passenger traffic decrease by -18.1% compared to a decrease of -43.4% for category 1 airports.

Insular regional airports and others attracting Low Cost/Leisure Carriers generally achieved the best performance in December 2021 compared to pre-pandemic (2019) levels, including: Ajaccio (+46.4%), Hammerfest (+8.9%), Calvi (+8%), Mikonos (-4.3%), Menorca (-4.3%), Palermo (-5.6%), Ponta Delgada (-10.9%), Fuerteventura (-13.1%) and Turin (-13.6%).

Freight & aircraft movement

Freight traffic in 2021 increased by +21.8% throughout the European airport network compared to last year, and stood at +7.7% above pre-pandemic (2019) levels - with only marginal variations between the EU+ market and the rest of Europe.

Aircraft movements were up by +23.3% compared to 2020 but down by -48% against pre-pandemic (2019) levels.

2022 Outlook

Looking at the months ahead, Jankovec said: “Uncertainties as to the evolution of the pandemic remain significant and limit visibility beyond a few months, at best. For now, the impact of Omicron is still very much on us as airlines keep pulling out flights and capacity in response to weakened demand in what is already traditionally a low season. This means the First Quarter will be disappointing but that we should hopefully see traffic take a better turn as Spring approaches. Whether this happens earlier depends on the pace at which travel restrictions can be lifted, now that Omicron is prevalent. A number of countries4 are moving in that direction, but much more needs to be done.

Today’s planned adoption by the EU of an updated Recommendation for intra-European travel should in principle confirm that travel regimes will at long last be based on traveller’s health status rather than their provenance. However, this will be meaningless unless Governments finally adhere to the plan and effectively coordinate.”

ACI EUROPE is the European region of Airports Council International (ACI), the only worldwide professional association of airport operators. ACI EUROPE represents over 500 airports in 55 countries. Its members facilitate over 90% of commercial air traffic in Europe. Air transport supports 13.5 million jobs, generating €886 billion in European economic activity (4.4% of GDP). In response to the Climate Emergency, in June 2019 its members committed to achieving Net Zero carbon emissions for operations under their control by 2050, without offsetting.