IATA reports strong passenger demand and stable cargo performance in June

Image courtesy IATA

Total traffic in June 2022 (measured in revenue passenger kilometers or RPKs) was up 76.2% compared to June 2021, primarily propelled by the ongoing strong recovery in international traffic. Globally, traffic is now at 70.8% of pre-crisis levels.

Domestic traffic for June 2022 was up 5.2% compared to the year-ago period. Strong improvements in most markets, combined with the easing of some Omicron-related lockdown restrictions in the Chinese domestic market, contributed to the result. Total June 2022 domestic traffic was at 81.4% of the June 2019 level.

International traffic rose 229.5% versus June 2021. The lifting of travel restrictions in most parts of Asia-Pacific is contributing to the recovery. June 2022 international RPKs reached 65.0% of June 2019 levels.

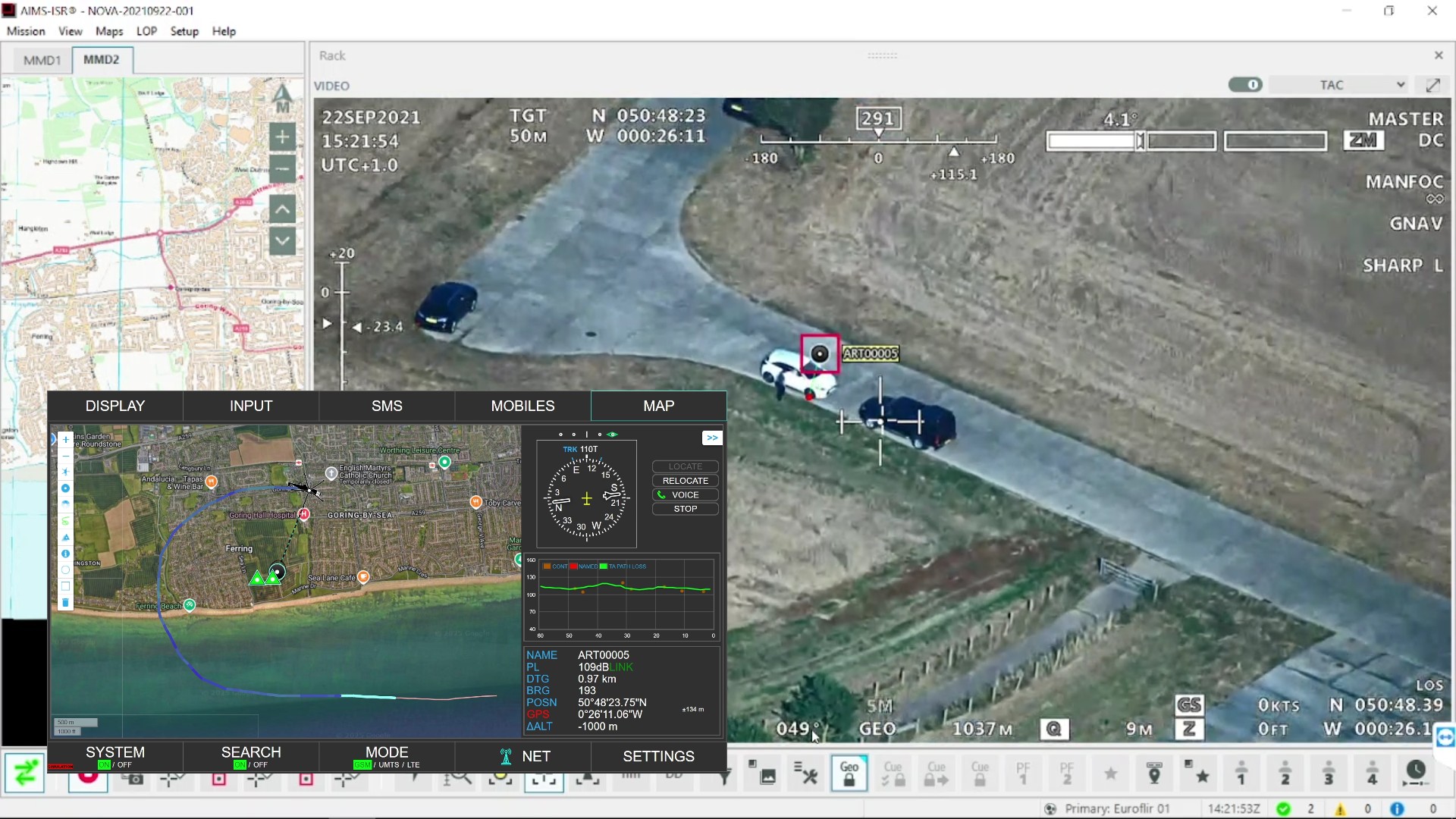

Willie Walsh (above), IATA’s Director General said: “Demand for air travel remains strong. After two years of lockdowns and border restrictions people are taking advantage of the freedom to travel wherever they can,” said Willie Walsh, IATA’s Director General.

International Passenger Markets

• Asia-Pacific airlines had a 492.0% rise in June traffic compared to June 2021. Capacity rose 138.9% and the load factor was up 45.8 percentage points to 76.7%. The region is now relatively open to foreign visitors and tourism which is helping foster the recovery.

• European carriers’ June traffic rose 234.4% versus June 2021. Capacity rose 134.5%, and load factor climbed 25.8 percentage points to 86.3%. International traffic within Europe is above pre-pandemic levels in seasonally adjusted terms.

• Middle Eastern airlines’ traffic rose 246.5% in June compared to June 2021. June capacity rose 102.4% versus the year-ago period, and load factor climbed 32.4 percentage points to 78.0%.

• North American carriers experienced a 168.9% traffic rise in June versus the 2021 period. Capacity rose 95.0%, and load factor climbed 24.1 percentage points to 87.7%, which was the highest among the regions.

• Latin American airlines’ June traffic rose 136.6% compared to the same month in 2021. June capacity rose 107.4% and load factor increased 10.3 percentage points to 83.3%. After leading the regions in load factor for 20 consecutive months, Latin America slipped back to third place in June.

• African airlines had a 103.6% rise in June RPKs versus a year ago. June 2022 capacity was up 61.9% and load factor climbed 15.2 percentage points to 74.2%, the lowest among regions. International traffic between Africa and neighboring regions is close to pre-pandemic levels.

Domestic Passenger Markets

• China’s domestic RPKs fell 45.0% year-on-year in June but this was a substantial improvement compared to May’s year-over-year performance as lockdown measures were eased.

• Japan’s domestic traffic was up 146.4% in June, compared to June 2021.

Walsh said: “With the Northern Hemisphere summer travel season now fully underway, predictions that the lifting of travel restrictions would unleash a torrent of pent-up travel demand are being borne out. At the same time, meeting that demand has proved challenging and likely will continue to be so. All the more reason to continue to show flexibility to the slot use rules. The European Commission’s intent to return to the longstanding 80-20 requirement is premature.

“Just look at the issues that airlines and their passengers at some hub airports are being confronted with. These airports are unable to support their declared capacity even with the current 64% slot threshold and have extended recent passenger caps until the end of October. Flexibility is still essential in support of a successful recovery.

“By capping passenger numbers, airports are preventing airlines from benefitting from the strong demand. Heathrow Airport has tried to blame airlines for the disruption. However, Service Level Performance data for the first six months of this year show that they have failed miserably to provide basic services and missed their Passenger Security service target by a massive 14.3 points. Data for June has not yet been published but is expected to show the lowest level of service by the airport since records began.”

Cargo

Global demand, measured in cargo tonne-kilometres (CTKs*), was 6.4% below June 2021 levels (-6.6% for international operations). This was an improvement on the year-on-year decline of 8.3% seen in May. Global demand for the first half-year was 4.3% below 2021 levels (-4.2% for international operations). Compared to pre-COVID levels (2019) half-year demand was up 2.2%.

Capacity was 6.7% above June 2021 (+9.4% for international operations). This was an increase on the 2.7% year-on-year growth recorded in May. Capacity for the first half-year was up 4.5% (+5.7% for international operations) compared to first half-year of 2021. Compared to pre-COVID levels demand was up 2.5%.

Air cargo performance is being impacted by several factors:

- Trade activity ramped-up slightly in June as lockdowns in China due to Omicron were eased. Emerging regions (Latin America and Africa) also contributed to growth with stronger volumes.

- New export orders, a leading indicator of cargo demand and world trade, decreased in all markets, except China.

- The war in Ukraine continues to impair cargo capacity used to serve Europe as several airlines based in Russia and Ukraine were key cargo players.

“Air cargo demand over the first half of 2022 was 2.2% above pre-COVID levels (first half 2019). That’s a strong performance, particularly considering continuing supply chain constraints and the loss of capacity due to the war in Ukraine. Current economic uncertainties have had little impact on demand for air cargo, but developments will need to be closely monitored in the second half,” said Walsh.

Asia-Pacific airlines saw their air cargo volumes decrease by 2.1% in June 2022 compared to the same month in 2021. This was a significant improvement over the 6.6% decline in May. Demand for the first half-year was 2.7% below 2021 levels. Airlines in the region have been heavily impacted by lower trade and manufacturing activity due to Omicron-related lockdowns in China, however this continued to ease in June as restrictions were lifted. Available capacity in the region fell 6.2% compared to June 2021. This contributed to capacity being 0.2% below 2021 levels for the first half of 2022.

North American carriers posted a 6.3% decrease in cargo volumes in June 2022 compared to June 2021. Demand for the first half-year was 3.3% below 2021 levels. High inflation is affecting the region. Demand in the Asia-North America market is falling and the Europe – North America market has started to decline. Capacity was up 5.6% in June 2022 compared to June 2021 and up 6.1% for the first half-year of 2022.

European carriers saw a 13.5% decrease in cargo volumes in June 2022 compared to the same month in 2021. This was the weakest performance of all regions. It was, however, a slight improvement over the previous month’s performance, which saw the sharpest fall in demand since early 2022. This is attributable to the war in Ukraine. Labor shortages and lower manufacturing activity in Asia due to Omicron also affected volumes. Capacity increased 5.6% in June 2022 compared to June 2021. Demand for the first half-year was 7.8% below 2021 levels while capacity was 3.7% above.

Middle Eastern carriers experienced a 10.8% year-on-year decrease in cargo volumes in June. Significant benefits from traffic being redirected to avoid flying over Russia failed to materialize. Capacity was up 6.7% compared to June 2021. Demand for the first half-year was 9.3% below 2021 levels, the weakest first half performance of all regions. First half-year capacity was 6.3% above 2021 levels.

Latin American carriers reported an increase of 19.6% in cargo volumes in June 2022 compared to June 2021. This was the strongest performance of all regions. Airlines in this region have shown optimism by introducing new services and capacity, and in some cases investing in additional aircraft for air cargo in the coming months. Capacity in June was up 29.5% compared to the same month in 2021. Demand for the first half-year was 21.8% above 2021 levels and half-year capacity was 32.6% above 2021 levels. This was the strongest first half performance of all regions.

African airlines saw cargo volumes increase by 5.7% in June 2022 compared to June 2021. As with carriers in Latin America, airlines in this region have shown optimism by introducing additional capacity. Capacity was 10.3% above June 2021 levels. Demand for the first half-year was 2.9% above 2021 levels and half-year capacity was 6.9% above 2021 levels.