IATA sees January passenger demand drop as cargo returns to pre-Covid levels

.jpg)

Image courtesy IATA

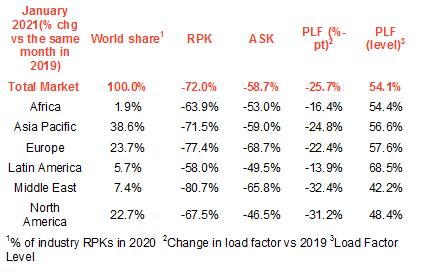

Because comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, unless otherwise noted all comparisons are to January 2019 which followed a normal demand pattern.

Total demand in January 2021 (measured in revenue passenger kilometers or RPKs) was down 72.0% compared to January 2019. That was worse than the 69.7% year-over-year decline recorded in December 2020.

Total domestic demand was down 47.4% versus pre-crisis (January 2019) levels. In December it was down 42.9% on the previous year. This weakening is largely driven by stricter domestic travel controls in China over the Lunar New Year holiday period.

International passenger demand in January was 85.6% below January 2019, a further drop compared to the 85.3% year-to-year decline recorded in December.

“2021 is starting off worse than 2020 ended and that is saying a lot. Even as vaccination programs gather pace, new COVID variants are leading governments to increase travel restrictions. The uncertainty around how long these restrictions will last also has an impact on future travel. Forward bookings in February this year for the Northern Hemisphere summer travel season were 78% below levels in February 2019,” said Alexandre de Juniac (above), IATA’s Director General and CEO.

International Passenger Markets

- Asia-Pacific airlines’ January traffic plummeted 94.6% compared to the 2019 period, virtually unchanged from the 94.4% decline registered for December 2020 compared to a year ago. The region continued to suffer from the steepest traffic declines for a seventh consecutive month. Capacity dropped 86.5% and load factor sank 49.4 percentage points to 32.6%, by far the lowest among regions.

- European carriers had an 83.2% decline in traffic in January versus January 2019, worsened from an 82.6% decline in December compared to the same month in 2019. Capacity sank 73.6% and load factor fell by 29.2 percentage points to 51.4%.

- Middle Eastern airlines saw demand plunge 82.3% in January compared to January 2019, which was broadly unchanged from an 82.6% demand drop in December versus a year ago. Capacity fell 67.6%, and load factor declined 33.9 percentage points to 40.8%.

- North American carriers’ January traffic fell 79.0% compared to the 2019 period, up slightly from a 79.5% decline in December year to year. Capacity sagged 60.5%, and load factor dropped 37.8 percentage points to 42.9%.

- Latin American airlines experienced a 78.5% demand drop in January, compared to the same month in 2019, worsened from a 76.2% decline in December year-to-year. January capacity was 67.9% down compared to January 2019 and load factor dropped 27.2 percentage points to 55.3%, highest among the regions for a fourth consecutive month.

- African airlines’ traffic dropped 66.1% in January, which was a modest improvement compared to a 68.8% decline recorded in December versus a year ago. January capacity contracted 54.2% versus January 2019, and load factor fell 18.4 percentage points to 52.3%.

Domestic Markets

- China’s domestic traffic was down 33.9% in January compared to January 2019, dramatically worsened compared to the 8.5% year-over-year decline in December. The fall was owing to stricter traffic controls ahead of the Lunar New Year holiday period amid several localised COVID-19 outbreaks.

- Russia’s domestic traffic, by contrast, rose 5.5% compared to January 2019, a turnaround from the 12.0% year-to-year decline in December versus the same month in 2019. It was driven by a fall in COVID-19 cases since a peak late in December and by national holidays in the first week of the month.

“To say that 2021 has not gotten off to a good start is an understatement. Financial prospects for the year are worsening as governments tighten travel restrictions. We now expect the industry to burn through $75-$95 billion in cash this year, rather than turning cash positive in the fourth quarter, as previously thought. This is not something that the industry will be able to endure without additional relief measures from governments.

Increased testing capability and vaccine distribution are the keys for governments to unlock economic activity, including travel. It is critical that governments build and share their restart plans along with the benchmarks that will guide them. This will enable the industry to be prepared to energize the recovery without any unnecessary delay,” said de Juniac.

Global standards to securely record test and vaccination data in formats that will be internationally recognized are urgently needed. “These will be critical to restarting international travel if governments continue to require verified testing or vaccination data. IATA will soon launch the IATA Travel Pass to help travelers and governments manage digital health credentials. But the full benefit of IATA Travel Pass cannot be realized until governments agree the standards for the information they want,” said de Juniac.

Cargo

Data for global air cargo markets released January 2021, shows that air cargo demand returned to pre-COVID levels (January 2019) for the first time since the onset of the crisis. January demand also showed strong month-to-month growth over December 2020 levels.

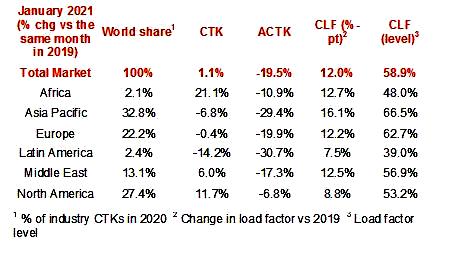

Because comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, unless otherwise noted all comparisons to follow are to January 2019 which followed a normal demand pattern.

Global demand, measured in cargo tonne-kilometers (CTKs*), was up 1.1.% compared to January 2019 and +3% compared to December 2020. All regions saw month-on-month improvement in air cargo demand, and North America and Africa were the strongest performers.

The recovery in global capacity, measured in available cargo tonne-kilometers (ACTKs), was reversed owing to new capacity cuts on the passenger side. Capacity shrank 19.5% compared to January 2019 and fell 5% compared to December 2020, the first monthly decline since April 2020.

The operating backdrop remains supportive for air cargo volumes:

- Conditions in the manufacturing sector remain robust despite new COVID-19 outbreaks that dragged down passenger demand. The global manufacturing Purchasing Managers’ Index (PMI) was at 53.5 in January. Results above 50 indicate manufacturing growth versus the prior month.

- The new export orders component of the manufacturing PMI – a leading indicator of air cargo demand– continued to point to further CTK improvement. However, the performance of the metric was less robust compared with Q42020 as COVID-19 resurgence negatively impacted export business in emerging markets. Should this continue or expand to other markers, it could weigh on future air cargo growth.

- The level of inventories remains relatively low compared to sales volumes. Historically, this has meant that businesses had to quickly refill their stocks, for which they also used air cargo services.

“Air cargo traffic is back to pre-crisis levels and that is some much-needed good news for the global economy. But while there is a strong demand to ship goods, our ability is capped by the shortage of belly capacity normally provided by passenger aircraft. That should be a sign to governments that they need to share their plans for restart so that the industry has clarity in terms of how soon more capacity can be brought online. In normal times, a third of world trade by value moves by air. This high value commerce is vital to helping restore COVID damaged economies—not to mention the critical role air cargo is playing in distributing lifesaving vaccines that must continue for the foreseeable future,” said Alexandre de Juniac, IATA's Director General and CEO.

January Regional Performance

- Asia-Pacific airlines saw demand for international air cargo fall 3.2% in January 2021 compared to the same month in 2019. This was an improvement from the 4.0% fall in December 2020. International capacity remained constrained in the region, down 27.0% versus January 2019, which was a deterioration compared to the 26.2% year-over-year decline recorded in December. The region’s airlines reported the highest international load factor at 74.0%.

- North American carriers posted an 8.5% increase in international demand in January compared to January 2019, far surpassing the 4.4% gain in December 2020 compared to December 2019. Economic activity in the US continues to recover and its January manufacturing PMIs reached a record-high, pointing to a supportive business environment for air cargo. International capacity fell by 8.5% compared to January 2019. In December 2020, capacity was down 12.8% versus the same month in 2019.

- European carriers’ international cargo demand slipped 0.6% in January compared to same month in 2019. This was an improvement from the 5.6% fall in December 2020 over the year-ago period. International capacity decreased 19.5%, a deterioration from the 18.4% year-to-year decline recorded for December.

- Middle Eastern carriers posted a 6.0% rise in international cargo volumes in January versus January 2019, which was an acceleration over the 2.4% year over year gain recorded in December compared to December 2019. Of the region’s key international routes, Middle East-Asia and Middle East-North America have provided the most significant support. January capacity was down 17.3% compared to the same month in 2019. This was a slight reduction compared to the18.2% decline recorded in December 2020 compared to the year-ago period.

- Latin American carriers reported a decline of 16.1% in international cargo volumes in January compared to the 2019 period, which was an improvement from the 19.0% fall in December 2020 versus a year ago. Drivers of air cargo demand in Latin America remain relatively less supportive than in the other regions. International capacity decreased 37.0% compared January 2019, largely unchanged from the 36.7% year-over- year decline recorded in December 2020.

- African airlines’ cargo demand soared 22.4% compared to the same month in 2019, eclipsing the 6.3% year-over-year increase for December 2020. Robust expansion on the Asia-Africa trade lanes contributed to the strong growth. January international capacity decreased by 9.1% compared to January 2019, reduced compared to the 17.8% capacity decline recorded in December 2020 versus December 2019.