IATA sees rising passenger and cargo growth in May

Image courtesy IATA

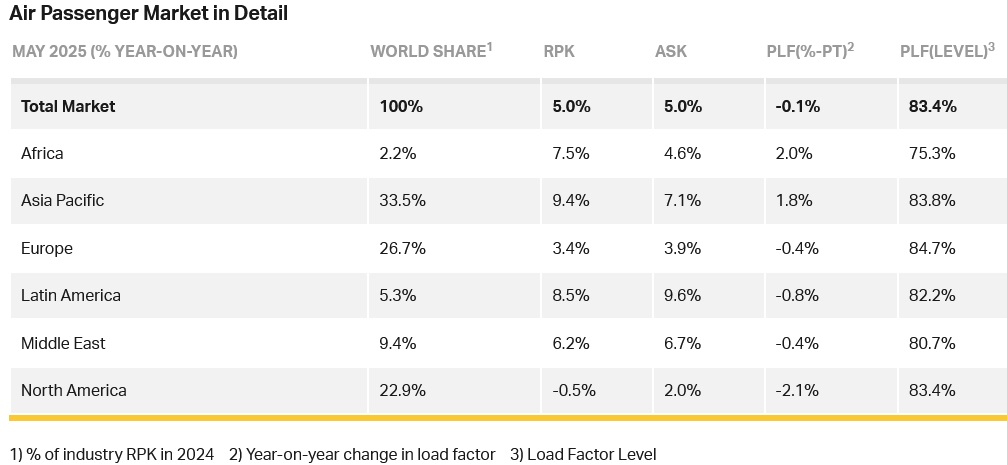

Total demand, measured in revenue passenger kilometres (RPK), was up 5.0% compared to May 2024. Total capacity, measured in available seat kilometres (ASK), was also up 5.0% year-on-year. The May load factor was 83.4% (-0.1 ppt compared to May 2024).

International demand rose 6.7% compared to May 2024. Capacity was up 6.4% year-on-year, and the load factor was 83.2% (+0.2 ppt compared to May 2024). This is a record load factor on international flights for May.

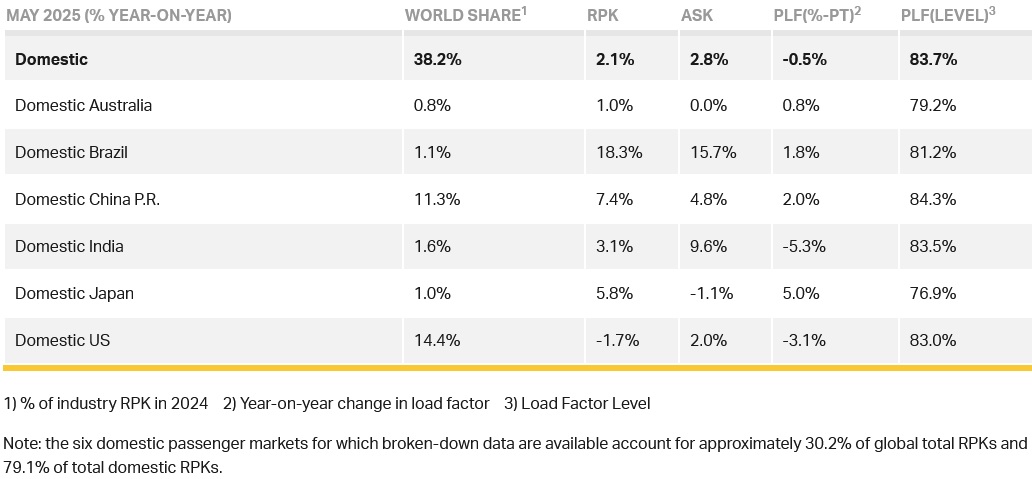

Domestic demand increased 2.1% compared to May 2024. Capacity was up 2.8% year-on-year. The load factor was 83.7% (-0.5 ppt compared to May 2024).

Willie Walsh (above), IATA’s Director General, said: “Air travel demand growth was uneven in May. Globally, the industry reported 5% growth with Asia-Pacific taking the lead at 9.4%. The outlier was North America which reported a 0.5% decline, led by a 1.7% fall in the US domestic market. Severe disruptions in the Middle East in late June remind us that geopolitical instability remains a challenge in some regions as airlines maintain safe operations with minimal passenger inconvenience. The impact of such instability on oil prices—which remained low throughout May—is also a critical factor to monitor. Importantly, consumer confidence appears to be strong with forward bookings for the peak Northern summer travel season, giving good reason for optimism.”

Regional Breakdown - International Passenger Markets

International RPK growth reached 6.7% in May year-on-year, with growth in all regions but a mixed picture on load-factors, which increased only by 0.2 ppt. Traffic expansion on most key international routes to the Americas slowed in May, apart from Transatlantic with a modest 2.5% year-on-year increase.

Asia-Pacific airlines achieved a 13.3% year-on-year increase in demand. Capacity increased 10.6% year-on-year, and the load factor was 84.0% (+2.0 ppt compared to May 2024).

European carriers had a 4.1% year-on-year increase in demand. Capacity increased 4.8% year-on-year, and the load factor was 84.0% (-0.6 ppt compared to May 2024).

North American carriers saw a 1.4% year-on-year increase in demand. Capacity increased 1.7% year-on-year, and the load factor was 83.8% (-0.3 ppt compared to May 2024).

Middle Eastern carriers saw an 6.2% year-on-year increase in demand. Capacity increased 6.3% year-on-year, and the load factor was 80.9% (-0.1 ppt compared to May 2024).

Latin American airlines saw an 8.8% year-on-year increase in demand. Capacity climbed 11.0% year-on-year. The load factor was 83.6% (-1.7 ppt compared to May 2024).

African airlines saw a 9.5% year-on-year increase in demand. Capacity was up 6.2% year-on-year. The load factor was 74.9% (+2.2 ppt compared to May 2024). Africa-Asia is the fastest-growing international corridor, with an expansion of 15.9%.

Domestic Passenger Markets

Domestic RPK rose 2.1% over May 2024 and load factor fell by -0.5 ppt to 83.7% on the back of a 2.8% capacity expansion. All regions showed growth except in the United States, due to economic slowdown and reductions in government travel. Chinese domestic travel growth accelerated, as it has been doing every month since March. Also notable is Brazil’s strong growth, on the back of unbroken expansion since January 2023.

May Air Cargo

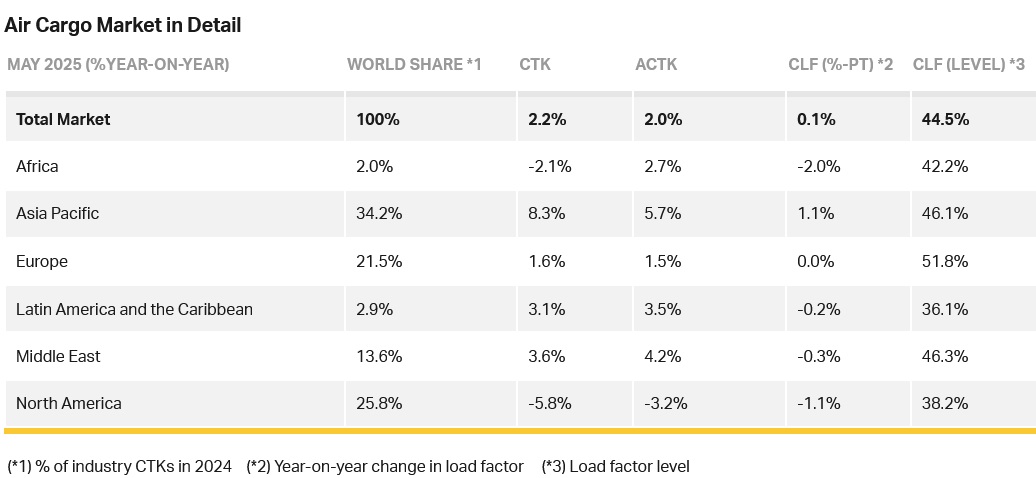

IATA data for May 2025 global air cargo markets shows total demand, measured in cargo tonne-kilometres (CTK), rose by 2.2% compared to May 2024 levels (+3.0% for international operations).

Capacity, measured in available cargo tonne-kilometres (ACTK), increased by 2.0% compared to May 2024 (+2.6% for international operations).

Willie said: “Air cargo demand globally grew 2.2% in May. That is encouraging news as a 10.7% drop in traffic on the Asia to North America trade lane illustrated the dampening effect of shifting US trade policies. Even as these policies evolve, already we can see the air cargo sector’s well-tested resilience helping shippers to accommodate supply chain needs to flexibly hold back, re-route or accelerate deliveries.”

Several factors in the operating environment should be noted:

Year-on-year, world industrial production rose 2.6% in April 2025. Air cargo volumes grew 6.8% over the same period, outpacing global goods trade growth of 3.8%.

Jet fuel prices in May 2025 were 18.8% lower than the previous year and 4.3% below the previous month.

Global manufacturing contracted in May, with the PMI falling to 49.1, below the 50 mark that signals growth. New export orders also remained in negative territory at 48, reflecting pressure from recent US trade policy changes.

May Regional Performance

Asia-Pacific airlines saw 8.3% year-on-year demand growth for air cargo in May, the strongest growth of all regions. Capacity increased by 5.7% year-on-year.

North American carriers saw a -5.8% year-on-year decrease in growth for air cargo in May, the slowest growth of all regions. Capacity decreased by -3.2% year-on-year.

European carriers saw 1.6% year-on-year demand growth for air cargo in May. Capacity increased 1.5% year-on-year.

Middle Eastern carriers saw 3.6% year-on-year increase in demand for air cargo in May. Capacity increased by 4.2% year-on-year.

Latin American carriers saw a 3.1% year-on-year increase in demand growth for air cargo in May. Capacity increased 3.5% year-on-year.

African airlines saw a 2.1% year-on-year decrease in demand for air cargo in May. Capacity increased by 2.7% year-on-year.

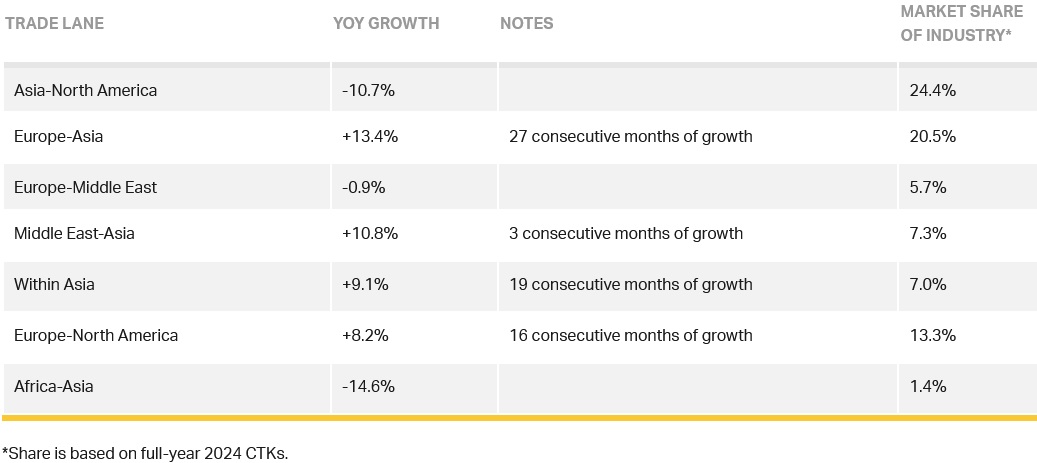

Trade Lane Growth: A significant decrease in the Asia-North America trade lane was expected and realized as the effect of front-loading faded (moving goods to market in advance of tariffs coming into effect) and changes to the de-minimis exemption on small package shipments (particularly those associated with e-commerce) were enforced. As cargo flows reorganised, several route areas responded with surprising growth.