IBA predicts more large orders of aircraft in 2025

Image copyright Shutterstock

IBA has published its analysis of the Paris Air Show 2025, confirming a total of 603 commercial fixed-wing passenger and freighter aircraft commitments, including firm orders, options, Letters of Intent (LoIs) and Memoranda of Understanding (MoUs). With many airlines posting healthy levels of profitability, stretched production slots and ageing fleets, IBA forecasts that this year’s Paris orders will be followed by further major commitments, with some of those expected to follow at the Dubai Air Show.

IBA’s Chief Economist, Dr Stuart Hatcher, initially predicted 700-800 aircraft commitments at the Paris Air Show at the start of June 2025, with a primary emphasis on the Middle East, India and Southeast Asia. Key players such as Riyadh Air, AviLease, Etihad, Qatar Airways, Air India, IndiGo and Pakistan International Airlines were all anticipated to be active participants. However, following the tragic Air India disaster, Indian and Boeing involvement at the show diminished, ultimately significantly reducing the volume of deals announced at Paris.

In its latest webinar analysing the outcomes and forward outlook from the Paris Air Show 2025, IBA reported 368 firm orders for commercial passenger and freighter aircraft at the show, marking a modest improvement over the 114 recorded at Farnborough 2024. While the figure remains well below the record-breaking 1,195 firm orders from Paris 2023, it surpasses the totals seen in 2015, 2017 and 2019. This signals a heightened level of demand despite the Air India tragedy and a range of economic and political factors that are impacting the aviation industry.

According to data from the IBA Insight platform, the number of aircraft options announced at Paris climbed to 210, up from just 72 in 2023, indicating that airlines are increasingly prioritising strategic flexibility amid long lead times and shifting fleet strategies.

As expected, Riyadh Air finalised a significant firm order for 25 Airbus A350-1000s, with an additional 25 options. Meanwhile, AviLease committed to 30 A320neos and 10 A350 Freighters, with additional options, confirming the anticipated surge from Gulf carriers and solidifying the Middle East’s position as a key growth region.

Overall, narrowbody commitments announced at Paris 2025 rose modestly to 338, up from 273 at Farnborough last year, while widebody commitments eased slightly from 157 to 89 this year. The most notable development came from the regional jet segment, which received 125 commitments - a dramatic rebound from zero at Farnborough 2024. This was driven primarily by SkyWest Airlines’ landmark commitment for 60 Embraer E175s, with 50 additional options, highlighting the need for regional aircraft fleet renewal.

Airbus maintained a commanding presence at Paris, with the value of announced commitments totalling over US$34 billion, significantly surpassing Boeing's US$4.7 billion. This was led by the A321-200NX which generated over US$8 billion in firm order value (124 aircraft) and an additional US$3.2 billion in options. The A350-1000 and A350 Freighter families also secured substantial interest, exceeding US$10 billion and US$4 billion respectively, including options.

IBA anticipates a strong second half of 2025, with large-scale commitments expected for both OEMs’ aircraft from key global operators. Potential announcements are anticipated at the Dubai Air Show or at other points before the end of the year. IBA predicts that a range of major airlines, including Emirates, Etihad, Qatar Airways, Ryanair and Royal Air Maroc, will place new orders across the A350, A320neo, A220, 737 MAX and 787 families.

Data from IBA Insight presented at the webinar also highlighted that aircraft delivery lead times remain elevated due to supply chain disruptions and surging demand. Average lead times for near-term deliveries currently exceed seven years for A320neo, 737 MAX and 787 family aircraft, whilst the A220 and A350 are approximately six years. Even with expected production ramp-ups between 2025 and 2030, lead times will continue to increase as backlogs grow above production rates.

IBA’s intelligence determined that airlines are operating from a stronger financial position than pre-pandemic levels. Global profitability is up 1.5% compared to 2019, while debt ratios have declined by 29%, though the average fleet age has risen by 16%, creating pressure to modernise. These conditions support IBA’s forecast for continued fleet investment through the remainder of 2025.

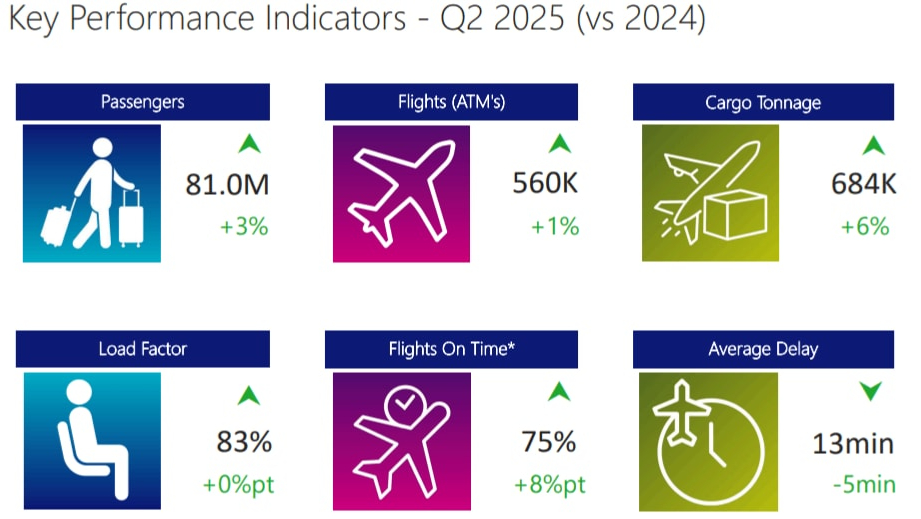

Q1 2025 airline performance was generally positive. For the 12-month period to the end of March, the Middle East saw a 0.5% quarter-on-quarter margin gain, now up 6% since Q1 2023. South America reported the second-highest operating margin at 12%. Results in Europe (9%), North America (6%) and Asia-Pacific (5%) remained stable.

IBA’s global weighted average risk rating for airlines dipped slightly to 69%, down from 72%, shifting to an orange rating, signalling caution amid ongoing global challenges.

With strong industry fundamentals and ongoing fleet renewal needs, IBA believes that the Paris Air Show 2025 is just one part of a wider ordering cycle this year. Attention will now turn to the 2025 Dubai Air Show and other announcements for additional aircraft commitments.