Inmarsat acquired by Viasat

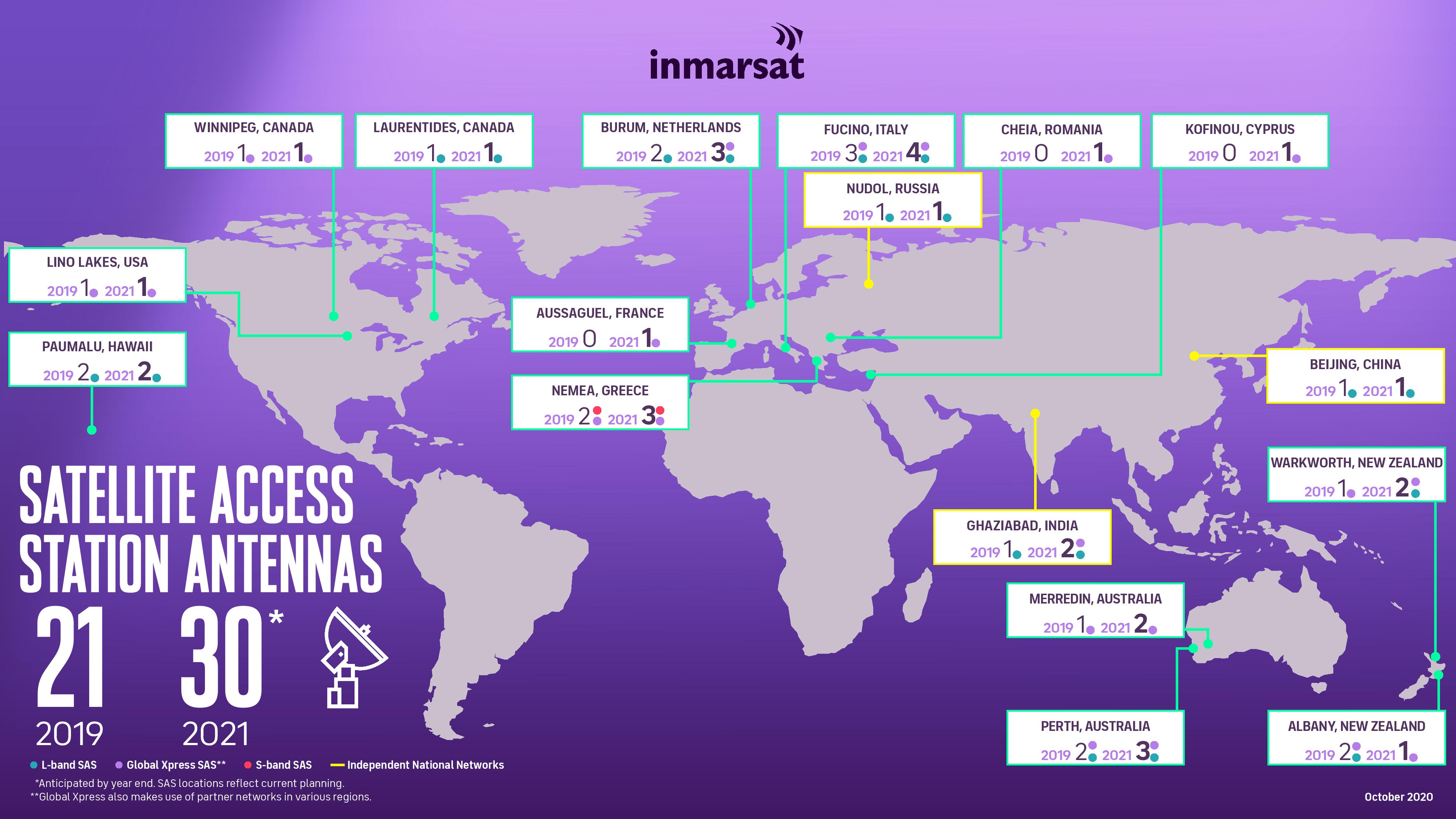

Above:

Inmarsat's worldwide Satellite Access Station antennas, highlighting the expansion of Inmarsat's ground network infrastructure, which forms part of its fully funded technology roadmap.

Courtesy Inmarsat

The combination will create a leading global communications innovator with enhanced scale and scope to provide secure and reliable global connections. The complementary assets and resources of the new organisation will enable the availability of advanced new services in mobile and fixed segments, driving greater customer choice in broadband communications and narrowband services (including the Internet of Things).

The combined company intends to integrate the spectrum, satellite and terrestrial assets of both companies into a global high-capacity hybrid space and terrestrial network, capable of delivering superior services in fast-growing commercial and government sectors. This advanced architecture will create a framework incorporating the most favorable characteristics of multi-band, multi-orbit satellites and terrestrial air-to-ground systems that can deliver higher speeds, more bandwidth, greater density of bandwidth at high demand locations like airport and shipping hubs and lower latency at lower cost than either company could provide alone.

Both companies have proven track records of product and service innovation. Viasat has advanced North American residential and aviation connectivity and defence communications with technology and business models embraced by customers. Viasat is also recognised for driving change through its pioneering ultra-high-capacity satellite technology, which has delivered superior value at attractive, affordable economics.

Inmarsat has an exceptional presence in the growing global mobility segment and is at the forefront of network design with its recently announced multi-dimensional mesh network. It is preparing to expand its global network later this year with its most powerful and advanced software-defined commercial communications satellites ever, offering both Ka- and L-band capabilities.

Inmarsat has a global presence, a robust distribution channel spanning the rapidly growing mobility, government, IoT and enterprise sectors and currently provides safety and connectivity services to more than one million mobility and defense platforms.

The combined company will be able to offer:

- A broad portfolio of spectrum licenses across the Ka-, L- and S-bands and a fleet of 19 satellites in service with an additional 10 spacecraft under construction and planned for launch within the next three years.

- A global Ka-band footprint, including planned polar coverage, to support bandwidth-intensive applications, augmented by L-band assets that support all-weather resilience and highly reliable, narrowband and IoT connectivity.

- The ability to unlock greater value from Inmarsat’s L-band spectrum and existing space assets by incorporating Viasat’s state-of-the-art beamforming, end-user terminal and payload technologies and its hybrid multi-orbit space-terrestrial networking capabilities.

- Viasat’s highly vertically-integrated technology and service offerings, along with Inmarsat’s extensive eco-system of technology, manufacturing and service distribution.

“This is a transformative combination that advances our common ambitions to connect the world. The unique fusion of teams, technologies and resources provides the ingredients and scale needed for profitable growth through the creation and delivery of innovative broadband and IoT services in new and existing fast-growing segments and geographies,” said Viasat’s Executive Chairman Mark Dankberg. “Inmarsat’s dual-band global mobile network, unique L-band resources, skills and capabilities in the U.K. and excellent technical and operational talent worldwide, are powerful complements to Viasat’s business. Together, we can advance broadband communications and create new hybrid space and terrestrial networks that drive greater performance, coverage, speed, reliability and value for customers. We look forward to welcoming the Inmarsat team into the Viasat family.”

“Joining with Viasat is the right combination for Inmarsat at the right time,” said Rajeev Suri, CEO of Inmarsat. “Viasat is a terrific innovator and Inmarsat brings some powerful additions: global reach, a broad distribution channel, robust business momentum and a presence in highly attractive global mobility segments. Together, the two companies will create a new global player with the scale and scope to help shape the future of a dynamic and growing industry. The combination will create a strong future for Inmarsat and be well-positioned to offer greater choice for customers around the world, enhanced scope for partners and new opportunities for employees. The industrial logic is compelling and ensures that the UK has a strong and sustainable presence in the critical space sector for the long term.”

Rick Baldridge, Viasat’s president and CEO added, “This strategic move gives Viasat the scale to increase the pace of innovation that drives new and better services for our customers, broadens the opportunities for our employees and provides a foundation for significant positive free cash flow, with potential upside from a revitalisation of L-band and IoT service growth. Plus, we will have expanded scale and presence in the $1.6 trillion broadband and IoT sectors. I’m excited about the opportunities ahead and looking forward to setting up the combined organisation for long-term success.”

Viasat says it plans to build on Inmarsat’s presence in the UK and is committed to preserving and growing the investment of the combined company in UK space communications, as well as supporting the recently published National Space Strategy.

The combined company will cooperatively engage with the UK government with a view to operating in the UK consistent with the commitments previously made by Inmarsat/Connect BidCo, and expects continued constructive engagement across the UK’s thriving innovation ecosystem. It further intends to work closely with the UK government to bring additional space capabilities and other advanced technologies to the country as well as long-term, highly skilled engineering and related jobs for UK-based employees.

Viasat plans to preserve and grow Inmarsat’s London headquarters, as well as its footprint in Australia and Canada and across Europe, the Middle East, Africa and Asia Pacific.

Under the terms of the agreement, Inmarsat’s shareholders will receive $850.0 million in cash, subject to adjustments, and approximately 46.36 million newly issued Viasat shares valued at $3.1 billion, based on the closing price of $67.00 per Viasat share on November 5, 2021. At closing, on a pro forma basis, Inmarsat shareholders are expected to be issued shares representing an aggregate of 37.5% of Viasat stock on a fully diluted basis, with each of the existing Inmarsat shareholders receiving shares representing less than 10%.

The combined company’s revenue and earnings profile is expected to be more diverse, resilient and global.Viasat estimates that the combined company has the potential for mid-teens percentage revenue and Adjusted EBITDA growth with a fully funded path to positive free cash flow, with upside from new IoT applications and greater utilisation of global space assets.

The transaction has been unanimously approved by the boards of directors of both Viasat and Inmarsat. In addition, The Baupost Group, L.L.C., Viasat's largest shareholder, has agreed to vote in favour of the transaction. At the closing of the transaction, Viasat intends to expand its board of directors from eight to 10 members, with Andrew Sukawaty, current chairman of Inmarsat, being appointed as one of the two new board members. A second new board member will be appointed at transaction closing by the current Inmarsat shareholders.

During the period prior to the closing of the transaction, Viasat expects members of Inmarsat’s management team to continue to execute its strategy and provide leadership, in-depth industry knowledge and customer relationship support. Decisions regarding management of the combined company following the closing of the transaction will be made as part of the integration planning process.

The transaction is expected to close in the second half of calendar year 2022, subject to the approval of Viasat stockholders, the receipt of certain regulatory approvals and clearances and the satisfaction of other customary closing conditions.

PJT Partners is serving as financial advisor to Viasat, provided a fairness opinion to the board of directors of Viasat and is also serving as capital markets advisor, arranging the committed financing for the transaction. Latham & Watkins LLP and Linklaters are serving as legal advisors to Viasat. Barclays, J.P. Morgan Securities plc and Trinity Advisers are acting as financial advisors to Inmarsat. Kirkland & Ellis, Clifford Chance and Steptoe & Johnson LLP are serving as legal advisors to Inmarsat and its majority shareholders.