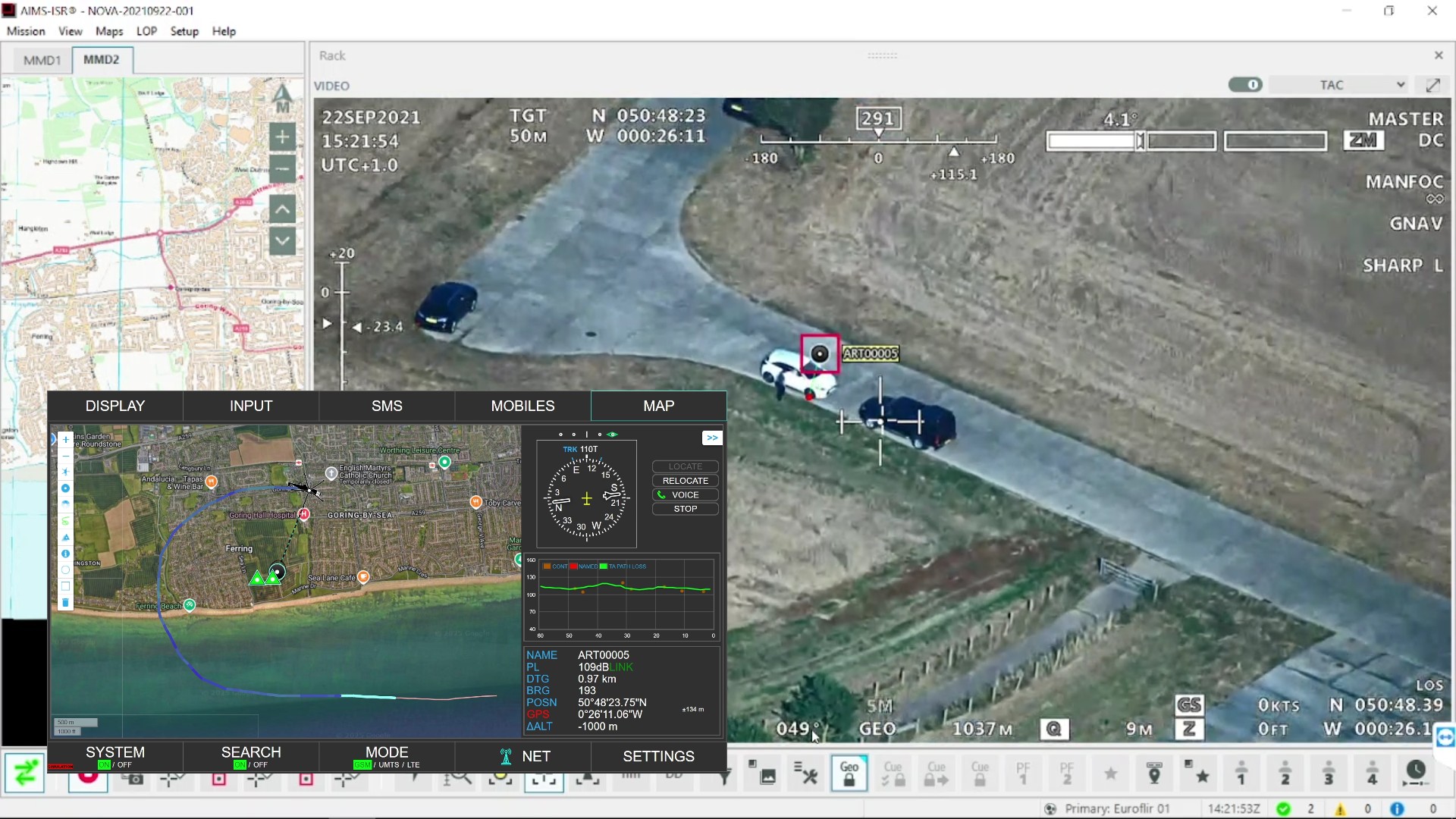

R&D tax relief benefits start-ups

Image courtesy TBAT

During the first few years of a running a start-up business, claiming R&D Tax Relief may be far from the top of your priorities. However, making a claim could return a significant amount of much-needed cash to your business.

Many technology-based start-up businesses are innovative by their very nature. They’re usually created after the owners identify a gap in the market along with a way to fill it with a new or improved product, process or service.

The first few years in particular are likely to be research and development intensive for a startup, as they put in the leg work to design and build their innovative offering. This activity makes start-ups the perfect candidates for R&D Tax Credit claims under HMRC’s SME Scheme.

Qualifying costs

When you start a business, you incur the costs of hiring staff, setting up facilities and buying materials and IT equipment etc., which can equal a hefty initial investment. Some of these start-up costs, along with ongoing business expenses may be utilised in an R&D Tax Credits claim.

Qualifying R&D costs for the SME scheme include:

• Salary costs – PAYE, National Insurance contributions, pension contributions, bonuses

and employee expenses

• Subcontracted R&D – outsourced qualifying R&D (included at 65% of cost)

• Materials – consumables used in the development of prototypes and for testing etc.

• Software licenses – software used specifically for R&D purposes

• Utilities – heat, power and light consumed in R&D processes

You can also claim for some qualifying indirect costs such as: maintenance, clerical, administrative and security work.

Why claim for a small start-up?

Here’s a few headline reasons why you should definitely investigate R&D Tax Credits if you’re a start-up business:

Many young innovative companies tend to employ few staff; however, these staff may be almost entirely focused on R&D. This means that much of their salaries and benefits are classed as eligible expenditure for an R&D Tax claim. In addition, the materials and software they buy are often used to develop their products and when internal expertise isn’t available, they subcontract R&D to other businesses. All this means that a significant proportion of their business costs may be eligible for R&D Tax relief.

The SME Scheme actually favours businesses who have yet to sell a product! If you’re premarket and loss making in the year of the claim, you will not pay any Corporation Tax and your entire R&D Tax Credit claim will be repaid as cash, directly into your business. This can be up to £0.33 for every £1 spent on eligible R&D expenditure, compared with up to £0.25

for a profit-making business.

If you do make a profit in the year, HMRC will use your claim to offset your Corporation Tax liability, and if there is anything remaining, you’ll receive a cash repayment.

If you put in place systems that help you record your eligible R&D activity and related expenses early on in the life of your company, it will help you optimise your claims moving forward.

Receiving that level of benefit for your company simply ‘doing its job’, could help you invest more heavily in R&D and progress your programme faster. It also serves to reduce some of the investment risk that goes along with creating highly innovative products, processes or services.

Many may have overlooked claiming R&D Tax Relief because it seems like too much work, which is why many start-up businesses engage a specialist R&D Tax Consultancy to build a claim on their behalf.